Tax Appraisal

Tax Appraisal

index

What is the Tax Appraisal?

This is a not necessarily commercial valuation that the SAT requests of the property in order to know the value and then be able to apply a tax, but with a study such as a tax appraisal the amount to be paid will be much more certain.

It is also used for the payment of fiscal taxes, as well as the payment of ISR, this value has NO relationship with the commercial value, since they are exclusively tax issues, for the purpose of setting a territorial tax, in Mexico it is known as contributions. These values are established by public entities for tax purposes (SHF).

A Tax Appraisal It can be classified into 3 different ones:

- Property valuation

- Appraisal for the Acquisition of Real Estate

- Appraisals for tax deduction for improvements (ISR)

What is a tax appraisal for?

The Tax Appraisals are used to calculate the Acquisition Tax (ISAI) and ISR As mentioned above, it is understood that through the physical value of the real estate we want to estimate the tax lien or the corresponding deductible, as required, this serves the tax authorities and/or the user.

When you want to sell a property, you contract an obligation, which is a mandatory payment of the ISR, based on the ISR law embodied in article 205, There is a possibility of estimating a deductible and therefore lowering the ISR lien payment in the process of selling a property as long as the investment expenses on the subject real estate can be verified.

As the real estate investment process begins to seek improvements, it is necessary to calculate the value of the investments made through real estate improvements and additions. Notice of completion of work. This is due to the provisions of article 121 of the ISR Law Part II.

Tax authorities may consider the valuation as part of the investment price when the costs are lower than the 10% compared to the investment costs included in the notice of completion of the work.

Who is authorized to carry out a tax appraisal?

In CDMX there are two people authorized to do this, in this case it can be a natural person or a legal entity as long as they have a current registration with the Federal Mortgage Society.

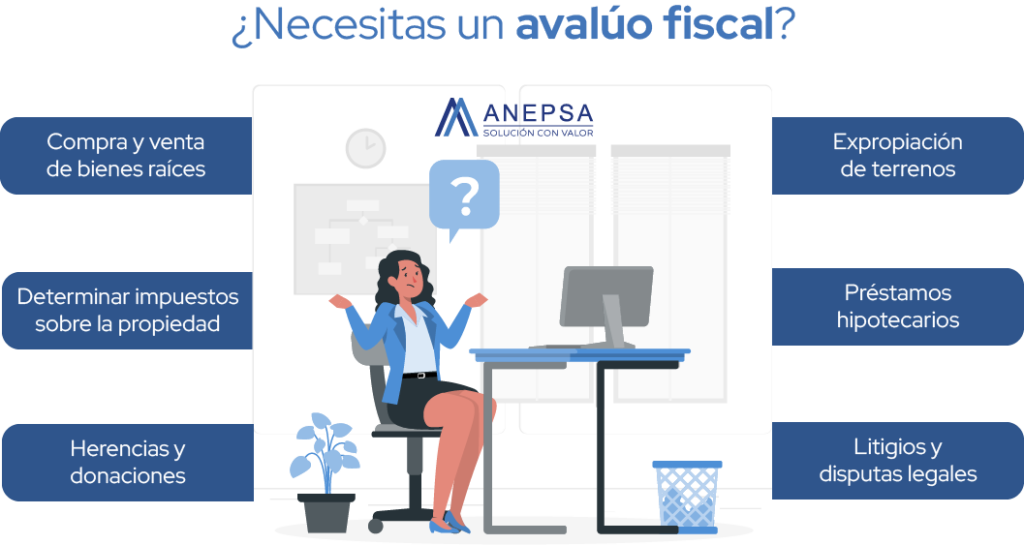

When is a tax appraisal necessary?

Subsequently, ISAI and ISR domain transfers will be made. Example once the property is obtained by:

- Buy and sell

- Mergers or Divisions

- Awards

- Testamentary Trials

It can also be used to implement a dedicated condominium system for a property. It must comply with the format linked and main to the method and in any case with the corresponding federal or municipal authority.

What aspects are taken into account?

In order to carry out the study of this appraisal, various factors need to be analyzed and among them are:

- Urban environment.

- Physicals conditions.

- Location.

- Type of finishes and their conditions.

- Use of the property.

- Types of properties in the area.

- The profitability of the property.

- Taking photographs for the tax appraisal report.

- Services in which property is counted.

In the case of a tax appraisal dated prior to the one to be carried out, the following procedure must be followed:

- Determine the value of the real estate on the date the study is being carried out

- The determined value must be adjusted according to the National Consumer Price Index of the immediately preceding month. to that in which the appraisal was carried out between the index of the month for which it is required.

- The result is the value of the asset as of the current date, the date on which the study was carried out.

How valid is a tax appraisal?

In accordance with article 3 of the Federal Tax Code, it is proposed that:

According to him Article 3: “The valuations made for tax purposes are valid for one year from the date of issue and the tax authorities accept valuations relating to assets provided to guarantee financing or profit, when it is essential to evaluate them with respect to the provided in Chapter III of Title V of the Code.”

The evaluation we referred to above must be carried out by the following professional appraisers.

- The Institute of Administration and Appraisals of National Assets

- Credit institutions

- Public corridors that have a current registration with the Ministry of Economy

- Companies dedicated to the sale or auction of goods

Who carries out tax appraisals?

The Tax Appraisal can only be carried out by an Appraiser with a professional license issued by the SEP in the field of Real Estate Appraisal, depending on the case or purpose of the service. In addition, the appraiser must have prior validity and certification before the SHF or as a registered appraiser. before the corresponding entity.

What documents do I need to request it?

As in all appraisals, documentation is required to prove the property, the following are necessary:

- Copy of water bill

- Copy of property receipt

- Architectural plans

- Copy of the deeds

What does the appraisal include?

- The value of the property is determined

- Architectural plans

- Photographic report

It varies depending on the type of appraisal requested.

Contact one of our Anepsa Global advisors and find out the requirements and availability to start your appraisal as soon as possible.