Business valuation

Business valuation

index

Have you wondered what it means to value a company?

When thinking about a company valuation, all kinds of complicated operations regularly come to mind, which in turn turns out to be an unimportant aspect for many.

On the other hand, the most common reason to carry out a company valuation is for the purchase and sale, although other reasons for this decision are programming, reorganization and validation.

When valuing a company, it is of great importance to consider different approaches and not just the valuation of its assets, so each of these characteristics makes it a complex process, but if done correctly, it generates information for the company. very useful that you should consider.

What is business valuation?

Business valuation is the process by which the components of a business are analyzed to establish its value.

Among the most important aspects are:

- The Heritage

- The viability of the company

- Competitiveness level

- Activity

- Potential

- Growth rate

To carry out the correct company valuation process, the mediation of people specialized in the field is necessary, such as: Financiers, lawyers, economists, actuaries, technologists, among others.

The purpose of valuing a company is to make an estimate about the value of the business at a certain time using methods that are based on prices, market comparisons, or generating cash flows.

Although there are accepted methodologies to carry out a business valuation, it is necessary and important that the appraiser or analyst who is in charge of this process has an extended sense and criteria about business, because each valuation is unique in nature. and each company also establishes its specifications.

Each company has different approaches, so depending on the area in which it operates, it may have a wide variety of assets that can range from special facilities, heavy machinery, industrial warehouses and furniture to industrial secrets, trademarks, patents and software.

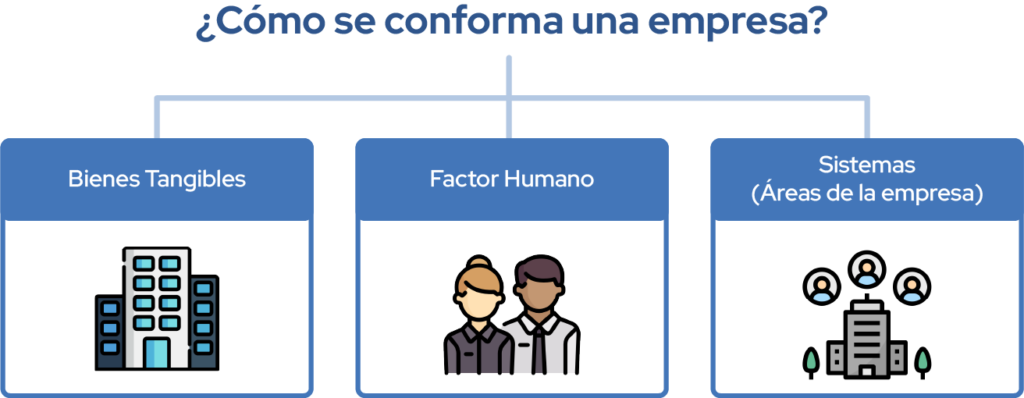

How is a company formed?

When talking about a company, reference is not only made to a brand or to those who head it, since when evaluated, three vital aspects are considered:

- Tangible goods: This includes land, buildings or equipment intended for production work, as well as additional machinery.

They also include raw materials intended for the manufacture of new products, which are required for a complete generation of the final product.

- Human factor: This is a very important element for the company since each position has a function, which requires evaluation and must be taken into account when making decisions. Here you can see different areas such as: employees, technical supervisors, managers and managers.

- Systems: Here the links that must exist between the people of the company and the teams that are established for the work are considered, thus having different areas: sales, systems, finances, marketing, production, etc.

What is the importance of valuing a company?

When carrying out valuations on a regular basis, making strategic decisions

or they may benefit from this choice, since they seek sustained and organized growth.

Taking into account the above, transparency is also provided to shareholders about the economic position regarding their investment, likewise, according to the method used, a market comparison is provided, which allows them to know the areas of opportunity or points in favor that they have for be able to create your business.

Below are other reasons why it is advisable to carry out a business valuation.

Concrete information to plan strategies.

- Buy and sell

- Confidence and assurance to those interested.

- IPOs

- Inheritances/Judgments

- Remunerations

- Arbitration developments

- Risk assessment

What type of methods are used to value a company?

Book value/Based on business assets

This valuation is based on the balance of results produced by a company based on values such as:

- The accountant

- The adjustable

- The liquidation

- The replacement

- Capitalization of income/Discounted cash flow

This method calculates the business value according to the estimated future money generation, so it allows you to see the ability of a company to produce profits.

To make this estimate, the following is used:

- Projection of results: The balances to be made available to pay shareholders are set.

- Setting discount rates: Calculation of the specific value of an asset at the end of the established time, that is, the residual value.

- Market capitalization: Here is the process used to carry out the valuation of companies according to characteristics whose valuations are easy to set when they are companies listed on the stock market.

Combination of methods or based on goodwill: Based on goodwill (Goodwill) or company dividends. It refers to intangible components that represent value for the company, such as social location, customers or the advantages that each company has.

What information is needed to value a company?

For these processes it is important to have qualitative and quantitative information such as:

Company financial statements

Company business planning

Financial projection of the company for 5 to 8 years.