Startup valuation

Startup valuation

index

What is a startup?

Currently there are different types of business models, a startup is a new company with many possibilities for growth since it uses new technologies to function, it can often be confused with an SME due to its size but it has different characteristics.

Some of the characteristics of a startup are:

- Innovation: Gaining a competitive advantage because a startup is always innovating in its technologies and products or services.

- Reach: These companies can have global reach because they use technologies as the basis of the company.

- Age: They are new companies and therefore do not have much experience in the industry.

- Costs: The costs of this business model are much lower than that of a traditional company since its main tool is technology and often online sales, which is why it has more benefits and monetary income, they use shared spaces for their place such as coworking and this is also a factor that helps save.

- Resources: For a startup, resources usually come from third parties, such as investors who see potential in the business.

- Scalability: These companies want to make profits in the short term, which is why they also have the risk of stagnating or going into decline.

Now that you know what a Startup is, we can talk about its benefits.

Advantages of a startup

- Acceptability to failure: This business model is intended to take risks to achieve very rapid reach, which is why they constantly try to apply new strategies and actions in order to reach the audience and they know that failure can be part of the development path. .

- Efficiency in decision-making: Having a small staff makes it easier to reach an agreement for timely and quick decision-making.

- High growth: Normally this company is structured to reach global levels, which is why they have products or services adaptable to different markets.

- Innovation: As the costs are not very high, failure may result in a situation that does not completely harm the company, which is why they innovate more easily unlike other types of business models.

- Clients: The interaction they have with clients is more personalized and by interacting almost directly with them you can learn about their needs and deficiencies.

Disadvantages of a startup

Just as this type of company can be very innovative and scalable, there are also not entirely good things that can be presented such as:

- Risks: There is a very high probability of losing the investment money since it is a business model that takes many risks.

- Responsibility: By usually having horizontal structures, the problems regarding responsibility are greater, since the hierarchies and activities are not entirely clear.

Some companies that were success stories and started as a startup are Spotify, Uber and Airbnb and today they are multi-million dollar and global companies.

How can you value a startup?

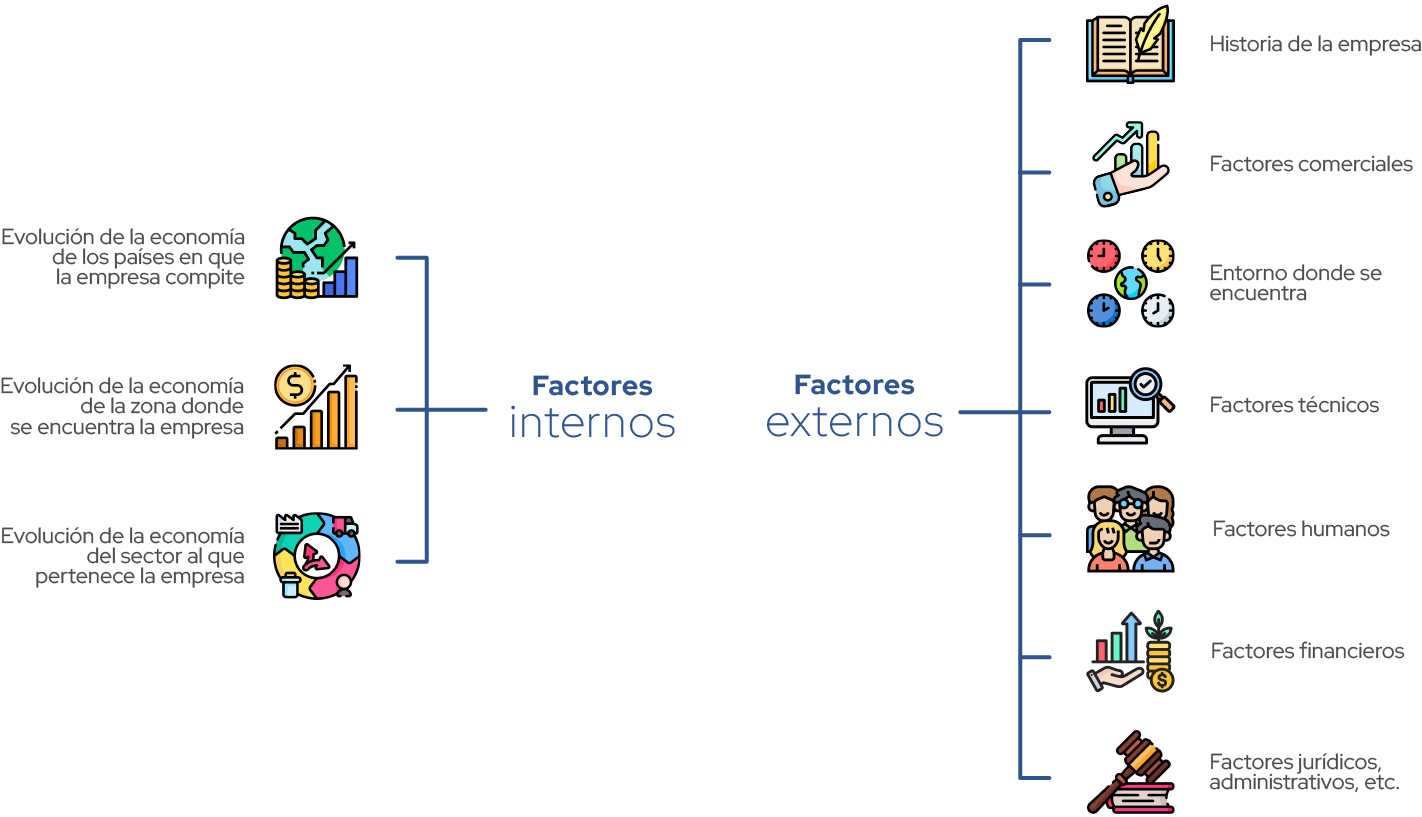

Every tangible or intangible asset can have a valuation in order to conclude its real value based on its characteristics. In the case of a startup or a company, both internal and external factors must be taken into account since the environment can have a positive or negative influence. negatively.

Among the internal factors are:

- The evolution of the economy of the area where the organization is located.

- Evolution of the economy of the countries where the company is present.

- Evolution of the economy of the sector to which the company belongs.

External factors:

- History of the company

- Commercial factors

- Environment where it is located

- Technical factors

- Human factors

- Financial factors

- Legal and administrative factors, among others.

Appraisal of a startup

This valuation allows the businessman to obtain a precise and concrete idea about the financial situation which allows him to calculate the profitability and liquidity of the company.

This type of study must take into account the internal and external factors in which the company finds itself, as we mentioned before, which has relevance in its socio-economic context to the valued objectives.

One of the main characteristics that the startup must meet is to be able to verify before the appraiser that it is optimally able to continue operating; The company must prepare its financial statements with a going concern hypothesis.

What methods are used in valuation?

COST APPROACH

Here the value of a property or economic unit is calculated that considers the possibility, as a replacement for it, it could be built and launched with an equivalent utility. The end result of this type of approach is knowing the replacement value.

MARKET FOCUS

This method calculates the value of the company based on some financial indicators and factors that are related to the sales price at which a recent transaction was carried out whose object was a similar company and in the same sector.

INCOME FOCUS

This valuation method establishes that the value of the company is the result of the sum of the present values of future free cash flows. This method even allows us to carry out asset valuations and also calculate the value of strategic and operational alternatives of companies.

Why is it necessary to carry out a startup appraisal?

By being able to concretely understand the risk/return relationship, entrepreneurs have a clear competitive advantage, as they will have better tools to diagnose problems, find solutions to problems and anticipate problems.

For any type of transaction, acquisition, merger, sale, placement of capital on the stock market, investment analysis and to evaluate and remunerate managers a valuation of this type is necessary, knowing the exact value of an asset is essential for an official procedure.

ANEPSA GLOBAL

With Anepsa Global it is possible for this and other types of appraisals to be carried out, contact us by leaving your information or sending a message through our social networks, we are here to provide you with advice and guide you so that you know what type of appraisal is best for you.