Fixed Asset Inventory

Fixed Asset Inventory

index

First we must explain what a fixed asset inventory is, this focuses on keeping an order of the assets that a company owns and that these are designed to be used in a transaction (sale, purchase, rental) as soon as possible. .

It is considered within the fixed assets from the most basic to the most complex, within the fixed assets they are separated into two parts into the existing ones and the fixed assets, the existing ones are the assets that are intended to be sold and the fixed assets are used to assist in company activities. Fixed assets also include the products that the company acquires from other places, and then the company sells them as they were acquired, these are called merchandise.

Fixed assets are divided into 2 categories, which are:

Intangibles: These assets do not physically exist; copyrights, patents, among others, fall into this category.

Tangible: Here come the elements that physically exist, some that are considered here are houses, machinery, buildings, land, etc.

What is a fixed asset inventory?

It is the process that is used to generally measure the fixed assets that a company owns, these range from real estate (offices, buildings, etc.) to office equipment, it does not matter if they are inside or outside a facility, as long as they serve for use by the company's workers or that are thought to be sold in the future. If the inventory is done under the “minimum visible unit” criterion, the result will have a higher quality.

Why should you take an inventory?

It is important that companies make an inventory of their fixed assets, as this prevents misuse of the company's money by spending on things that they may already have and by not keeping an inventory, they are not realized. account. Even to pay taxes because all the objects they have within the assets are declared in different chapters of the tax laws.

What are the properties of a company that go into fixed assets?

Fixed assets are considered to be assets that are owned by a company and that are not intended to be marketed in any way; they remain in the company for an indefinite period of time. What is classified within fixed assets are: real estate, automobiles, machinery, land, among others, these are counted as tangible assets, intangible objects such as: software, patents, etc. are also taken into account.

Types of Fixed Asset Inventories

Seasonal Inventory: It is used when, during low seasons, it is used to increase production, thinking that there is no shortage of products during high demand seasons.

Inventory in Transit: In this inventory, the products that will arrive from the suppliers to the company are organized.

Safety Inventory: It is designed for when a company produces extra products, whether the demand for certain products increases or preventing failures during production that delay the release of the products to the market.

Decoupling Inventory: It is required for occasions when there are two production processes that require working separately.

Raw Materials Inventory: This is used when a company has acquired more raw materials than usual, and this causes them to produce more products than they normally produce.

Physical Inventory: Here the record is kept of all the physical or intangible assets that are part of the company, in this you can know more accurately the quantity and where all the assets are located.

Cyclical Inventory: It is the counting of products from time to time, all within the fiscal year.

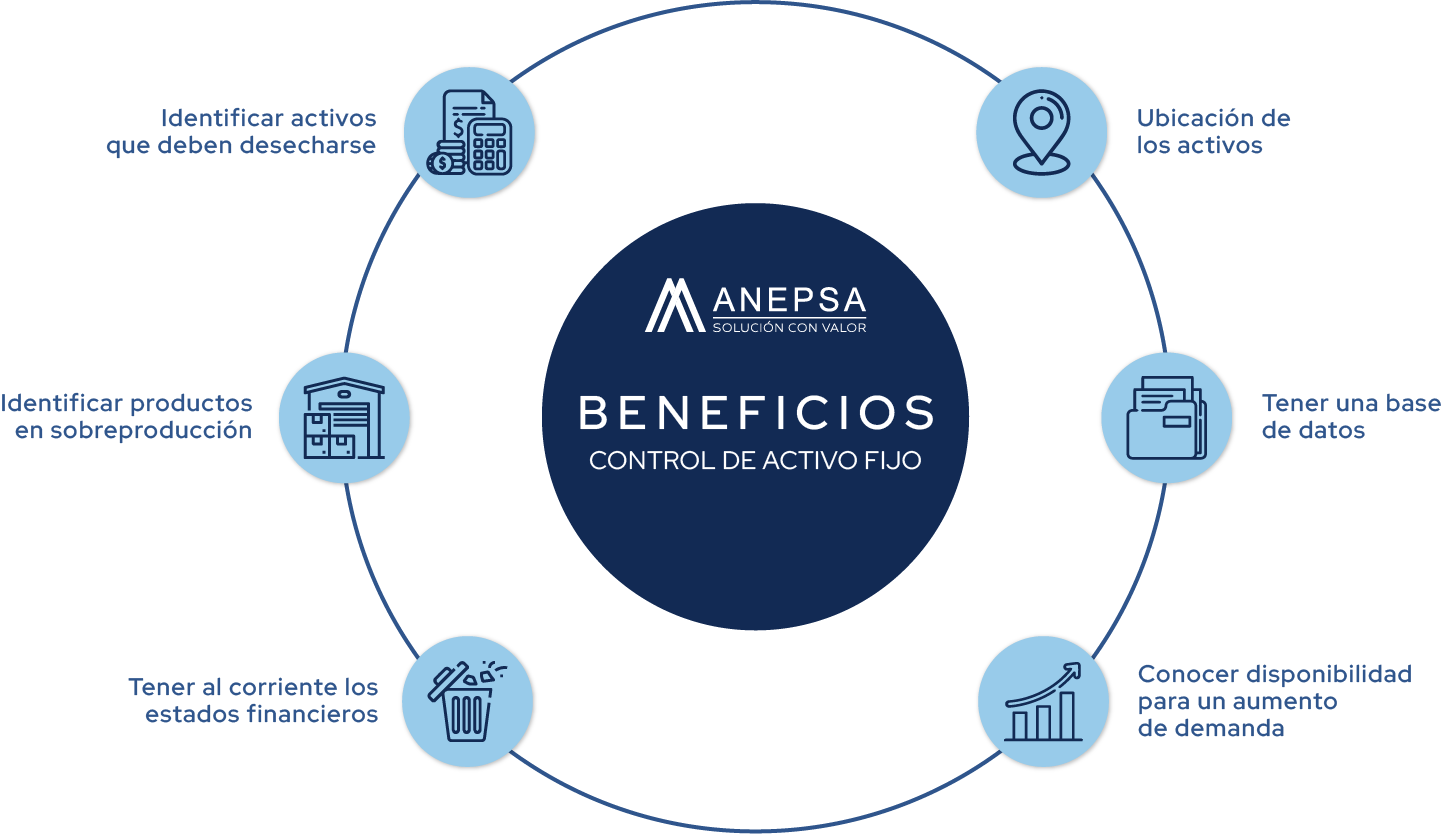

Benefits of carrying out a fixed asset inventory

Making a fixed asset inventory helps to have a more general view of what assets a company owns, to know where they are physically located and if they are already registered in its database, as well as to know if it has enough products to be able to cover a possible increase in demand.

Another benefit is that you can know which assets are no longer useful to the company and be able to discard them, either because they are in poor condition or have become obsolete compared to other products. The inventory also helps to indicate which products are overproduced.

It even helps that by keeping an inventory you are complying with Colombian law which establishes that companies must have all their financial statements up to date and also have them available, so that an inspector can review them at any time through the accounting books.

ANEPSA GLOBAL

With Anepsa Global it is possible for this and other types of appraisals to be carried out, contact us by leaving your information or sending a message through our social networks, we are here to provide you with advice and guide you so that you know what type of appraisal is best for you.