Mergers and acquisitions

Mergers and acquisitions | business valuation

index

What are mergers and acquisitions?

The constant need for the business of increasing income and reduce costs, speed up the processes, innovate or improve the services for toast extensive experience to the customer, use new technologies and continue being competitive in his field, forces to the businessmen to test various transactions, as mergers I acquisitions, the acquisition of a company, also called shareholding, is the process by which a company hire a part of the social capital of another company to obtain he control partial or total of that company, according to percentage and distribution acquired, capital and company shares, yes good this process can be carry out through a contract buying and selling, there are other ways to do it.

The two most common are: Leverage and public offering of Actions.

What are the benefits of the Mergers and Acquisitions service?

Provides to clients trust for develop expansion plans and assume risks to the to integrate new businesses, technologies, brands or assets in their operational teams. As part of this service, the company is evaluated by adjusting the fair value of assets and debts, as well as negotiations between the parts, the depth investigation and closing of the business, during which the consolidated financial statements are adjusted in accordance with national standards either international.

Why do I need the Mergers and Acquisitions service?

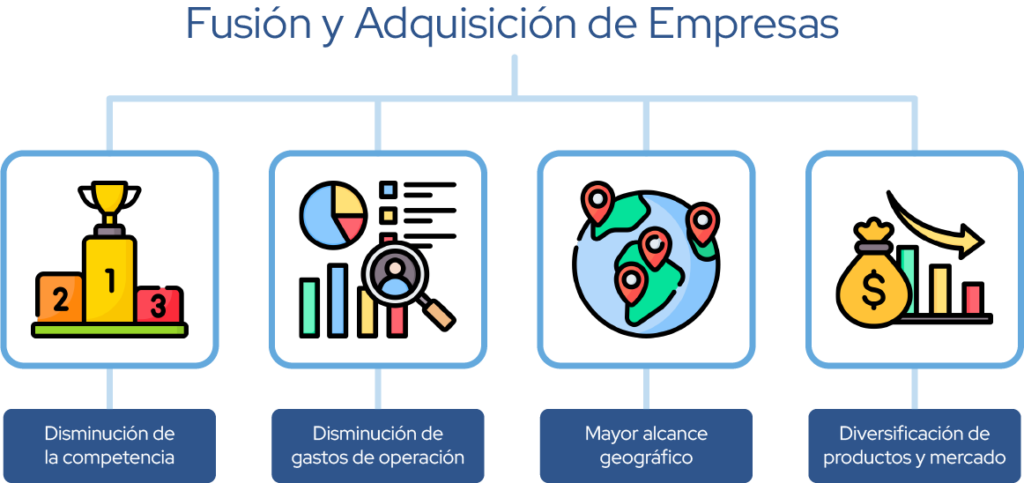

- Decreased Competition: Sometimes it is decided to acquire a competing company since in this way there is the possibility of covering a larger market share and thus reducing the expenses that would have to be incurred to improve the innovation or processes of the company against which one wants to compete. .

- Reduction in Operating Expenses: Sharing spaces helps with the reduction of rent costs, payment of services and even fixed operating expenses of companies.

- Greater Geographic Scope: When you buy a company that has geographical locations in areas where the company you want to acquire does not yet have a presence, you can reach a market more quickly without having to enter into long and in some cases more expensive processes when wanting to do it on your own. .

- Product and Market Diversification: The purchase or merger of companies that do not necessarily share the same products or markets. which allows a larger market to be achieved in a shorter period of time, as well as allowing the dependency rate on a single market or service to be lowered.

What is Business Integration?

Horizontal Integration

The acquisition or merger of one company with another, while companies compete in the same industry, is carried out with the objective of finding economies of scale that reduce average unit costs, as well as seeking to gain more "market power" and share. market, thus capturing the majority of the industry's consumers. This type of consolidation also allows the adaptation of technologies and processes developed by competitors to achieve better results in a shorter period of time, growth and innovation.

Vertical integration

This is when a company buys from a supplier to produce its inputs (backward integration) or buys its production from one of its customers (forward integration).

What are the main reasons for buying a company?

Liquidity

When a company is in a growth stage, it is often necessary to recapitalize shareholders or reinvest dividends, which may be difficult for some shareholders, as reinvesting all capital would be illiquid; Among other things, the sale of some or all of the operations may be an incentive to acquire more of the liquid inheritance.

Expansion

When companies are in the growth or development phase, they do not always have the financial, organizational or technical means to continue with the project, the operation or others complete the development of the project and benefit economically from the sale of the business when it has not yet been completed. generated a positive flow or reached a balance point.

Better opportunities

Sometimes, when evaluating the results of investments in the company, it is revealed that there are opportunities in the market that can provide a higher return, in order to obtain the necessary funds for investments in these markets and obtain greater profits, it is decided sell the stake so that the company can use other investment opportunities

Family Succession

In various situations where a business is passed down from generation to generation, there is a risk that no successor will want to take control, which may lead to the sale of all or part of the business.

Shareholder Conflicts

There may be differences between shareholders due to the policies and practices adopted by the company; This may lead to a decision to sell shares or change partners.

ANEPSA GLOBAL

With Anepsa Global it is possible for this and other types of appraisals to be carried out, contact us by leaving your information or sending a message through our social networks, we are here to provide you with advice and guide you so that you know what type of appraisal is best for you.