Small Business Valuation How is the value of a small business calculated?

index

Small business valuation is an essential process that helps determine the actual and potential value of a business. Through this analysis, owners, investors, and other stakeholders can make informed decisions about investments, mergers, acquisitions, or strategic planning.

What is business valuation and why is it necessary?

Business valuation involves using a variety of techniques to determine the value of a company based on its assets and performance. While there are multiple valuation methodologies, they all seek to determine the true value of a company.

The importance of valuing a business goes beyond simply buying or selling. Here are some situations where a business valuation is necessary:

- Mergers and Acquisitions: When two companies consider merging or one company wants to acquire another, it is essential to conduct a detailed valuation to determine fair value and negotiate appropriate terms.

- Debt Restructuring: In cases where a company is facing financial difficulties and needs to restructure its debts, valuation can help determine the company's ability to meet its financial obligations and negotiate terms with creditors.

- Licensing or Franchising: If a company wants to license its products or expand through franchising, the value of the brand, assets and revenue potential needs to be determined, which requires a valuation.

- Litigation and Arbitration: In legal disputes involving the value of a company or its assets, an objective valuation can be crucial to resolving conflicts and determining compensation.

- Financial and Strategic Planning: To set long-term financial goals, plan for expansion or diversification, it is essential to have a clear understanding of the current value of the company.

- Sale of Assets: When a company decides to sell part of its assets, whether a production plant, property or technology, a valuation is necessary to establish a fair sale price.

- Regulatory and Tax Compliance: Tax and regulatory authorities may require valuations to ensure that companies comply with regulations and to calculate taxes on transactions or assets.

- Valuation of Intangibles: In an increasingly knowledge- and technology-based economy, the valuation of intangibles such as patents, trademarks, copyrights and goodwill has become increasingly relevant.

- Investments: If you are considering investing in a company, it is crucial to know its value. This will allow you to receive a specific amount of equity or shares in exchange. For entrepreneurs seeking funding in private equity rounds, an accurate valuation is essential to demonstrate to investors the value of their company and the expected return on their investment.

- Compensation of workers: By linking employee pay to the company's performance and value, you can establish a valuation system. If the company has increased its value at the end of the period, you can reward employees. This motivates the team to contribute to the company's growth.

- Inheritance or donation: In situations where a business is inherited or received as a gift, it is essential to know its value. This will help you understand the magnitude of the inherited business and calculate the corresponding taxes.

How is the value of a small business calculated?

As we mentioned earlier, there are a variety of business valuation methods, but not all of them are suitable for valuing a small business. Some methods are designed primarily to value large corporations or publicly traded companies, and are not well suited for small businesses.

Valuation methods can be classified into two main categories:

- Static methods: They value the company based on its history and current situation.

- Dynamic methods: They value the company considering its ability to generate income in the future.

These two approaches can yield very different results. For example, a company with accumulated losses but a promising future could be valued much lower using static methods than using dynamic methods.

- Net book value: This is one of the simplest and most straightforward techniques for valuing a small business that does not have an extensive financial history or a large amount of intangible assets. This method is based on the difference between the company's assets and liabilities according to its balance sheet.

Net Asset Value Formula:

Net Asset Value = Total Assets − Total Liabilities

- Mixed methods: They combine elements of static and dynamic methods to provide a more comprehensive and realistic valuation of small businesses. These methods leverage the strengths of both approaches to overcome their individual limitations.

- Adjusted Discounted Cash Flow (DCF) Method: It combines the DCF approach (dynamic method) with adjustments based on net book value (static method). It uses future cash flow projections discounted to present value, but also considers the net value of equity as an adjustment or as a starting point.

- Adjusted Market Multiples Method: Combines the market multiples approach (static method) with adjustments based on the future growth and potential of the company (dynamic method). It uses multiples from comparable companies or recent transactions in the sector, but adjusts these multiples taking into account the projected growth of the company to be valued.

- Multiples methods: They offer a relatively simple and quick way to obtain a valuation based on comparisons with similar companies in the market.

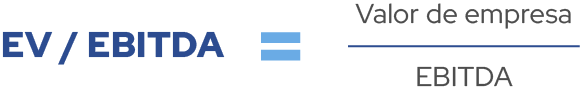

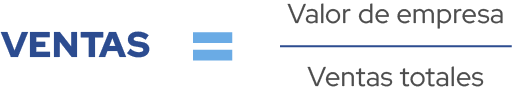

- Enterprise Value/Evenings Multiple (EV/Sales): Compares the total value of the company to its total revenue. It is useful for early-stage companies or companies that are not profitable but have high revenue growth potential.

Formula

Enterprise Value/Operating Cash Flow (EV/OCF) Multiple: Compares the total value of the company with the operating cash flow. It is useful for evaluating the company's ability to generate cash from its operations.

Formula:

- Discounted cash flow methods: These are valuation techniques used to estimate the present value of a company's future cash flows. Although they are traditionally associated with large companies or investment projects, they can also be applied to small businesses.

- Discounted Free Cash Flow (DCF): This is the most common DCF method. It consists of projecting the company's free cash flows (Operating Cash Flow less investments in working capital and capital expenditures) and discounting them to present value using an appropriate discount rate.

Basic formula:

- Discounted Cash Flow to Shareholders (Equity DCF): Similar to traditional DCF, but focuses on cash flows available to shareholders, i.e. after paying off debts and necessary investments.

- Terminal Value Method: In DCF valuation, a significant portion of the value typically comes from projected cash flows in a future period, known as the “terminal value.” This terminal value is typically calculated by applying a growth rate to the projected last year’s cash flows and then discounting it to present value.

Basic formula:

Which valuation method is best for a small business?

When faced with a business valuation, we recommend not limiting yourself to just one method. It is beneficial to use multiple methods to obtain a range of values and determine a more accurate valuation range.

Each valuation method has its own strengths and limitations. Some methods are more suitable for companies with significant assets, such as industrial or commercial companies, while others are more appropriate for companies with fewer assets but a high profit-generating capacity.

Valuation method | Advantages | Disadvantages | Types of suitable companies |

Net book value | – Simple and easy to understand. – Based on available financial information. | – It does not consider the value of intangible assets. – It does not reflect future value. | Companies with well-defined tangible assets. |

Mixed Methods | – Combines strengths of different methods. – Provides a more comprehensive valuation. | – It can be complex to implement. – Requires detailed data. | Companies with diverse assets and operations. |

Multiples Methods | – Quick and easy to apply. – Based on comparable market data. | – Dependence on comparable companies. – Does not consider the company’s particularities. | Companies with good comparables in the market. |

Discounted Flow Methods (DCF) | – Consider the time value of money. – Assess future cash flows. – Flexible in projections. | – Requires precise projections. – Sensitive to discount rates. – It depends on future assumptions. | Companies with clear and consistent cash flow projections. |

What elements are taken into account in a small business appraisal?

In a small business appraisal, a variety of elements are considered to determine the actual or potential value of the business. These elements provide a comprehensive view of the financial, operational and strategic health of the business.

- Historical Financial Information:

- Financial statements (balance sheet, income statement, cash flow).

- Sales history, profit margins and profitability.

- Projected Cash Flows:

- Projections of future income, expenses and cash flows.

- Growth and expansion estimates.

- Tangible and Intangible Assets:

- valuation of physical assets (real estate, machinery, inventory).

- valuation of intangible assets (patents, trademarks, goodwill).

- Liabilities and Obligations:

- Debts, loans and financial obligations.

- Employment commitments and other contingent liabilities.

- Profit Generating Capacity:

- Profitability and operating margin.

- Operational efficiency and productivity.

- Competitive Position and Market:

- Market share and competitive position.

- Industry analysis and market trends.

- Management Team and Human Talent:

- Experience and skills of the management team.

- Capabilities and training of key personnel.

- Risks and External Factors:

- Macroeconomic and regulatory factors.

- Operational, commercial and financial risks.

- Customer Flow and Business Relationships:

- Client portfolio and established business relationships.

- Long-term contracts and agreements.

- Strategy and Business Plan:

- Vision, mission and strategic objectives.

- Business plan and growth strategy.

- Sensitivity Analysis and Scenarios:

- Evaluation of different scenarios and assumptions.

- Sensitivity analysis to changes in key variables.

- Legal and Compliance:

- Compliance with laws, regulations and standards.

- Pending litigation and legal contingencies.

These elements are analyzed in a comprehensive manner to obtain a complete and accurate valuation of the company. Depending on the valuation method used, some elements may be more relevant than others. It is important to have a valuation team or expert who can evaluate each of these elements in an appropriate and professional manner.

How does ANEPSA help you?

In ANEPSA We offer accurate, reliable valuation services tailored to the specific needs of each of our clients. Our team of experts combines advanced and up-to-date technical skills with a deep understanding of the market and business dynamics, ensuring a comprehensive and detailed valuation.

Furthermore, we are distinguished by our commitment to excellence, professional ethics and customer satisfaction, guaranteeing a transparent, confidential valuation process aimed at obtaining the best value for the company.