Going business appraisal

What is a going concern appraisal? | Going Concern Appraisal | Business Valuation

index

What is a going concern appraisal?

Going concern appraisal is a process that allows determining the value of a company by considering various elements, such as fixed assets, current assets, liabilities, brand, technology and the economic and technical environment of the organization. The purpose of this appraisal is to perform a comprehensive analysis that values the company as a going concern, using discounted cash flow methodologies adjusted by an appropriate discount rate.

This analysis includes a commercial appraisal of fixed assets, which refers to the minimum cost that the company would have as a going concern. Aspects such as freight costs, labor, import expenses, engineering and installation are evaluated. In addition, factors such as physical condition, obsolescence, maintenance and market situation are taken into account, which allows the total cost of fixed assets to be determined.

A going concern is an economic entity that is expected to continue operating in the future. The definition of a going concern is based on assumptions underpinning Financial Reporting Standard A-2, which indicates that it is considered an entity that will generate continuing economic benefits.

The going concern concept considers the valuation of the company as a business with continuous operation at present value (discounted cash flows). This implies that the financial value of an asset is favored over an indefinite life period. For a correct valuation, it is essential to analyze the assets in their entirety and make a re-valuation that allows determining their updated value based on the business purpose.

This study may include different categories of value, such as liquidation value, “fair value,” and “strategic or investment value.” These categories are useful depending on the specific situation of the organization and the strategic decisions that shareholders may make.

What is the scope of a going concern appraisal?

The scope of a going concern appraisal involves assessing the viability and potential of the business, using a discounted cash flow approach that is tailored to the characteristics of the business in question. This process also includes a commercial appraisal of the entity's fixed assets, which represents the minimum value that would be assigned to it as a going concern.

The main objective is to analyse and determine the level of associated risk, identifying critical factors that can influence the success or failure of an investment. It is essential to carry out a multi-scenario assessment and a sensitivity analysis, as the approach may vary depending on the purpose of the appraisal.

Method for carrying out an appraisal of a going concern

To determine the most appropriate appraisal method, it is important to answer several key questions:

- What will be evaluated?

- What business or product will be evaluated?

- What is the purpose of business appraisal?

- What approach is required for appraisal?

- What is the sector to which the company belongs?

- Is there public or private information about the sector?

Forecasting an organization's value requires analyzing its historical performance, as well as that of other companies in the sector, industry trends, and analyst projections. Standardizing accounts can help more accurately predict the effects of valuation, incorporating necessary adjustments to reflect cross-industry behavioral practices.

Common methods for going concern and financing options

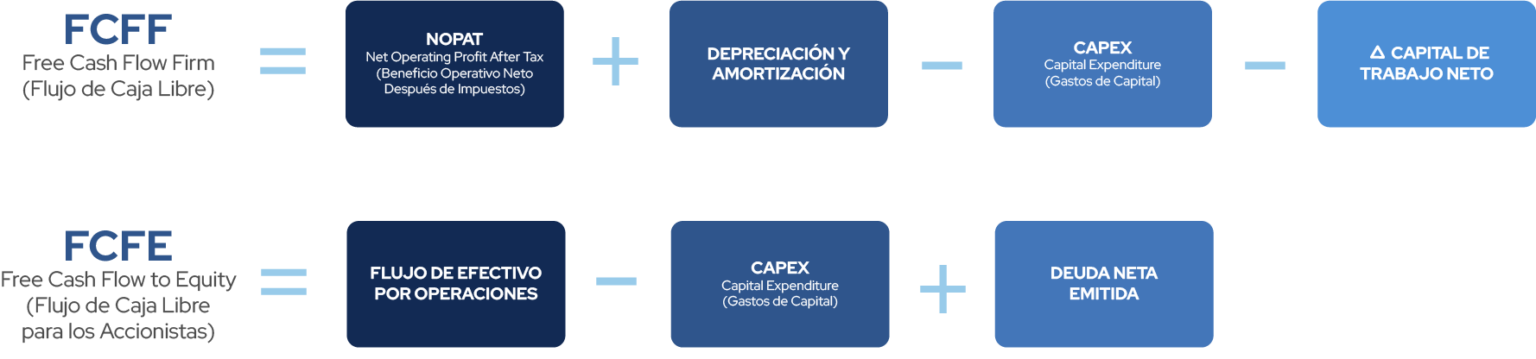

The most commonly used methods for valuing a going concern include “Discounted Cash Flows (FCFF and FCFE).” This approach is particularly effective for companies undergoing technological change or innovation. In the realm of financial options, the Black & Scholes method is one of the most common.

Objectives for determining the value of a company

The objectives of a business appraisal may include:

- Mergers and acquisitions

- Shareholder restructuring

- Valuation of publicly traded companies

- Identification and prioritization of “value drivers”

- Strategic decisions on business continuity

- Spin-offs

- Change of series in shares

- Testamentary successions

- Trading

Other cases that require appraisal of a going concern

There are less common situations that require the appraisal of a going concern, where the cost method can be used. Some examples are:

- Real estate

- Capital intensive industries

- Some financial institutions

- Companies with losses or low profits (bankruptcy)

The market method is also used when an acquisition is required based on similar transactions in a common sector. This may involve intrinsic value along with strategic value, which requires a thorough analysis of the transaction's track record.

ANEPSA GLOBAL

With Anepsa Global it is possible for this and other types of appraisals to be carried out, contact us by leaving your information or sending a message through our social networks, we are here to provide you with advice and guide you so that you know what type of appraisal is best for you.