Consulting for the sale of a company - Business valuation

index

1. Why sell a company?

Selling a business can be a strategic decision motivated by a variety of reasons. Owners may choose to sell their business in order to capitalize on favorable market opportunities, maximize the value of their investments, meet personal or business financial needs such as liquidity to fund additional projects or lack of succession to continue the business. Additionally, selling the business may be part of a broader strategy, including restructuring the business portfolio, consolidating the industry, or focusing on areas of greater growth potential. Ultimately, the decision to sell a business may be influenced by financial, strategic, and personal considerations.

There are various reasons why business owners may choose to sell their business, we can divide them into two categories: Personal and work-related.

LABOR | PERSONAL |

Maximizing value | Lack of succession |

Focus on core business | Owner fatigue or exhaustion |

Financial needs | Retirement |

Business strategy | Withdrawal |

Opportunity for growth | Changing priorities |

Changes in the business environment | Conflicts between partners |

Tax benefits | Lack of time |

2. Business Valuation Methods

There are usually four different methods used to determine the value of a company, and of these, the discounted cash flow method stands out as one of the most used.

- Discounted cash flows

- Multiples

- Book Value

- Mixed or Goodwill

2.1 Discounted Flows or Cash Flow

This method seeks to determine the value of a company from the expected future cash flows, which are discounted at present using a rate that reflects risk Associate. This is considered the most robust and conceptually correct approach, as it evaluates the company as a cash generator.

To apply it, it is required:

A detailed forecast of income and expenses (sales, operating payments, administrative expenses, etc.).

The selection of a appropriate discount rate, which takes into account factors such as risk and volatility.

The value of the shares depends directly on the the company's ability to generate money for its shareholders, so this method is the most accurate in reflecting that capacity in financial terms.

2.1.1 Basic Cash Flows

|

|

|

|

|

|

|

|

2.2 Multiples method

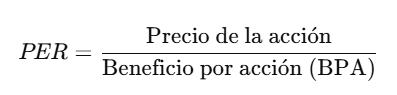

The financial multiples are practical tools that relate the price of an asset to key financial variables of the company. A common example is the Price-Earnings (PER) multiple, which compares a share's price with its corresponding earnings, i.e., earnings per share (EPS). Its calculation is simple:

This methodology stands out for its simplicity and intuition, making it one of the most widely used methods for valuing companies, especially in the stock market.

However, it is important to consider that, precisely because of its simplicity, multiples can overlook key business factors such as expected growth, capital structure, or operational risk. Therefore, while they are an excellent quick comparison tool, They do not replace in-depth analysis and complete value of a company.

2.2.1 Main multiples

PER (Price to Earnings Ratio)

Relate the share price with the net earnings per share (EPS)It is one of the most common indicators for valuing companies.

Interpretation: A high P/E may indicate growth expectations, while a low P/E may suggest undervaluation.

Limitation: It does not consider factors such as future growth or risk, so it should not be used in isolation.

PBR or PVC (Price to Book Ratio / Value)

Compare the market price of the share with his book value per share (net worth).

Interpretation: A PBR > 1 indicates that the market values the company above its book value, which may reflect positive expectations.

Importance: Measures the financial strength of a company and the perceived value of its assets.

PEG (Price/Earnings to Growth Ratio)

Relate the PER with the BPA growth rate.

Interpretation:

PEG ≈ 1 → Fair valuation in relation to growth.

PEG < 1 → Possible undervaluation.

PEG > 1 → Possible overvaluation.

Use: More useful than the isolated PER, since it incorporates the factor growth. It must be analyzed in the context of the sector and the market.

2.3 Book Value Method

He book value method values a company or asset based on the data recorded in its accounting books, especially in the balance sheetThis approach considers the net value resulting from subtract liabilities from total assets (tangible and intangible), thus reflecting the accounting equity of the company.

Advantages:

Simple and objective, as it is based on audited figures.

Useful in companies with easily valued tangible assets and operational stability.

Limitations:

It does not reflect the potential for future income generation.

Can underestimate or overestimate the actual value if assets are depreciated or liabilities are not fully recorded.

Not suitable for intensive companies intangible assets such as trademarks or intellectual property.

2.4 Mixed method or Goodwill

He mixed method, also known as goodwill method, is a valuation technique that combines elements tangible (as physical assets) and intangibles (such as brand or reputation), with the aim of offering a more complete and realistic view of a company's value.

Unlike purely accounting methods, this approach recognizes that part of business value is not recorded in the books, especially when it comes to intangible assets.

He goodwill Represents the additional value a buyer is willing to pay beyond the book value. Some examples include:

Reputation and brand positioning

Customer base loyalty

Human capital and team know-how

Intellectual property (patents, trademarks)

These intangible assets can generate sustained benefits over time, which justifies a premium in the company's purchase price. Therefore, the mixed method is especially useful in mergers, acquisitions, or valuations of established businesses with a strong market presence.

3. Preparing for the Sale: What Should You Do Before Selling?

Analyze the decision to sell your company

Before starting the sale of your company, it's crucial to reflect on the reasons behind this decision and the goals you want to achieve. This analysis will allow you to structure a more effective sales plan. Furthermore, potential buyers, such as entrepreneurs or investors, will want to know every detail of your business. Transparency and clarity are essential to building trust and preventing the process from becoming frustrated.

Develop a solid strategy

It's important to plan ahead before starting the sale. Establishing a solid strategy is essential to avoid mistakes. Consider legal, tax, and employment issues, and make sure your finances are in order. Keep detailed records of income, expenses, and inventory, as buyers will want to review all financial data before making a decision.

Preparing the business for the transition

Prepare your employees to ensure operations continue to run efficiently without your presence. Designate a trusted employee with the experience and skills necessary to handle daily responsibilities. Make sure your staff is trained and able to work independently, which will make your business more attractive to buyers.

Review legal issues

Review all current contracts before the sale. Some contracts, such as employment contracts, may be transferable, but others are not. It's essential that you understand the legal implications and inform the buyer of all the responsibilities they will assume by acquiring the business.

Increase the company's sales

A solid cash flow makes your business more attractive to buyers. Plan strategies to increase sales, such as digital marketing campaigns, launching new products or services, and expanding your customer base. This not only improves the perceived profitability of your business but also increases its value.

Seek professional advice

Selling a business is a complex process that requires experience. It's advisable to hire a professional to help you find the right buyer, negotiate on your behalf, and guide you throughout the entire process. An expert can also help you establish a fair value for your business.

Filter the right buyers

Not everyone interested in buying your company is suitable. It's vital to prequalify buyers to ensure they have the financial capacity and genuine interest. Make sure they sign a confidentiality agreement to protect sensitive business information.

Maintain confidentiality

It's important not to make the sale public until it's finalized. If it's not completed, it can raise questions about your company's quality and delay the process. Maintain confidentiality and seek professional advice to ensure the process is carried out safely and efficiently.

4. What can affect the sales process?

Once your company is ready for transfer, it's essential to proceed with extreme caution during the negotiation. The buyer will require complete and accurate information about the company, so manipulating or falsifying this information could invalidate the transaction, result in compensable damages, or, in extreme situations, constitute the crime of document forgery.

Since confidential information cannot be shared without protection, it is crucial to implement the process of due diligence, which allows for secure auditing of this information. To adequately protect it, confidentiality clauses must be included to ensure the integrity of the process.

It's advisable to retain external advice during this phase, which could include the involvement of appraisers, independent auditors, and possibly a sales team to manage the transaction.

Furthermore, the participation of potential buyers requires additional precautions. Purchase offers may require additional guarantees, such as insurance, guarantees, deposits, or sureties. The choice of these instruments will depend on the specific circumstances of each case.

Finally, having a legal team specialized in tax, business, and legal matters is essential before proceeding with the sale. This team will provide the necessary support to manage the process properly and minimize legal risks.

5. Identification of Potential Buyers

Finding potential buyers for a company can involve a variety of strategic approaches and specific tactics.

By combining different approaches and strategies, you can expand your options and increase your chances of finding potential buyers interested in acquiring your company.

Market research | Professional networks | Financial intermediaries | Advertising and marketing | Events and conferences |

-Market analysis – Competitor analysis for potential buyers | -Contact colleagues, trade associations, investors, financial advisors and other experts in the field. | – Investment banks, business brokers or financial advisors | -For promotion | -Participate to connect with potential buyers |

Competitor Research | Online platforms |

-Investigate similar competitors who may be potential buyers | -Specialized platforms for sales and promotion |

6. Negotiation and Favorable Agreements in the Sale of Companies: How to Do It?

Negotiating a successful sale of your company requires strategic skills, patience, and a deep understanding of both the seller's and buyer's objectives and needs. To achieve this, it is essential to prepare thoroughly, including a detailed understanding of your company's assets, liabilities, strengths, weaknesses, and future projections. Furthermore, setting clear and realistic objectives for the sale is key.

An accurate assessment of the company and understanding the market in which it operates are fundamental steps that support your arguments and help avoid disagreements during the negotiation. Identifying key negotiating points, maintaining effective communication, and focusing on mutual interests are crucial to reaching satisfactory agreements.

Flexibility and creativity, along with the support of professional advisors, also play an important role in successfully navigating the process. By following these steps and adopting a collaborative approach, you will significantly increase your chances of obtaining favorable terms in the sale of your business.

7. Maintain Confidentiality

Protecting confidentiality during the sale process of a business is essential to safeguarding its reputation, stability, and value. Before sharing any sensitive information, it is essential that potential buyers sign a confidentiality agreement. Limiting access to such information to only those authorized and necessary for the process is key.

It's advisable to use secure communication methods, such as encrypted emails or secure virtual rooms, to share confidential details with buyers and advisors. It's also crucial to carefully assess the suitability and credibility of buyers before providing them with information.

It's important to keep employees informed about the sales process in a limited and controlled manner to prevent unwanted leaks. Furthermore, procedures should be established to monitor compliance with confidentiality agreements and respond quickly to any breach or leak of information.

With these precautions, you'll ensure the sales process is carried out safely, maintaining the integrity and value of the company.

8. Maximize Company Value

Maximizing a company's value before its sale requires implementing a series of strategies aimed at improving its attractiveness and revenue-generating capacity. One of the main actions is financial optimization, which consists of improving the company's financial health, reducing unnecessary costs, efficiently managing cash flow, and maximizing profit margins.

It is also essential develop sustainable growth strategies, such as expansion into new markets and diversification of revenue sources. Additionally, improve asset quality and value of the company, adopt efficient management practices, and invest in brand and reputation building are key elements to increase the value perceived by buyers.

No less important is maximize the client portfolio, ensuring their loyalty and expanding the base. Finally, before starting the sales process, carry out a comprehensive company evaluation Addressing any existing weaknesses is essential to ensure the company presents itself at its best and maximizes its market value.

9. Ongoing Support During the Sales Process: Who Can Help You?

Selling a business is a complex process that can greatly benefit from the support of specialized experts. Depending on your needs, you can seek help from a variety of professionals, such as:

Business brokers: They help in the search for potential buyers and facilitate the negotiation process.

Lawyers specializing in mergers and acquisitions: They ensure that the process complies with all legal regulations and protect your interests throughout the transaction.

Financial advisors: They provide guidance on the financial structure of the sale and the tax implications, helping to maximize the value of the transaction.

Business valuation specialists: They carry out an accurate valuation of the company, ensuring that a fair price is obtained.

Business strategy consultants: They help structure a sales strategy and improve the company's competitive position before the sale.

Marketing and public relations professionals: They promote the sale of the company and manage its reputation to attract potential buyers.

Depending on your goals and the approach you want to take, you can rely on one or more of these experts to ensure the sales process is successful and efficient.