Valuing a business - How do I calculate the value of my business?

index

1. Business Appraisal

1.1 What is a company appraisal?

A business valuation is a fundamental process in the world of finance that is used to determine the economic value of a company at a given time. This analysis is crucial for a variety of situations, from mergers and acquisitions to issuing shares in the public market, obtaining financing or long-term strategic planning.

In essence, business valuation seeks to determine how much an investor would be willing to pay for a stake in the company, or how much the company would be worth as a whole, which involves evaluating a wide range of factors, including the company's assets and liabilities, its future cash flows, its competitive position in the market, the economic and political environment in which it operates, among other aspects.

There are multiple approaches and methods to perform a business valuation, Each with its own techniques and assumptions, these may include comparative analysis, where the company's financial data is compared with other similar companies in the market, the discounted cash flow method, which estimates the present value of the company's expected future cash flows, among others.

Ultimately, an accurate and robust valuation is critical to making informed, strategic financial decisions, as it provides a clear understanding of a company's intrinsic value and helps investors, managers and other stakeholders assess investment potential and make informed decisions.

1.2 What is a business appraisal for?

- It facilitates the establishment of a fair price that satisfies both parties in purchase and sale transactions, since by using the appropriate approach, it is possible to establish an average price considering both the maximum that the buyer is willing to pay and the minimum that the seller is willing to accept. In addition, it serves as an indicator of profitability, productivity and growth potential, as well as to evaluate the financial health of a company and its ability to obtain loans.

- Improves the efficiency of the business succession process, especially in situations such as inheritances or share acquisitions

- In IPOs, you can set the initial share price, making it easier to attract investors by offering a compelling value proposition.

- In matters of inheritance and wills, it establishes the relative value of shares compared to other assets, facilitates strategic decision-making on business units and investments by identifying areas of underperformance that require adjustments and also serves to evaluate the performance of managers, as well as establish compensation based on results, allows to know the price and market value of the company within its industry.

- It facilitates obtaining credit or financing by providing solid support. It is essential to support arguments in arbitration disputes.

2. How to calculate the value of a company to sell?

Calculating the value of a company for sale involves evaluating a number of financial and operational factors to determine its market price.

First, it is crucial to evaluate the financial statements of the company, including the balance sheet, income statement, and cash flow statement, revenues, costs, profit margins, assets, and liabilities should be examined to understand the company's financial health.

Then, the most appropriate valuation method must be chosen For the company, common methods include the income approach, the net book value approach, and the market approach. Depending on the nature of the company and the industry in which it operates, one method may be preferred over another.

Once Once the valuation method has been selected, the following must be apply the corresponding formulas To calculate the value of the company, for example, if the income approach is being used, future cash flows can be projected and discounted to present value using an appropriate discount rate.

In addition to the financial aspects, should be considered other factors that may influence the value of the company, such as its market position, its brand, its customer base, its leadership team, and its potential for future growth.

It is advisable to consider Hire a business valuation professional to obtain an accurate and objective valuationAn expert can help properly evaluate all relevant aspects of the company and determine a fair and competitive price for the sale.

Once Once you have estimated the value of your business, you are ready to negotiate a sales price with potential buyers. You should be prepared to discuss and justify your proposed price, and consider the terms of the sale, such as down payment, future payments, and contingencies.

3. Business Valuation Methods

3.1 Book Value

He book value It is the company's assets according to its financial records. It is calculated as:

Assets – Liabilities = Net Worth

It's a simple and objective method based on accounting information. However, it doesn't always reflect true market value, as it doesn't consider factors such as growth potential or brand.

3.2 Adjusted Book Value

This method starts from the book value, but makes settings to better reflect the company's economic reality. For example:

The value of assets (such as property or machinery) is updated to their market price.

They are considered contingent liabilities or off-balance sheet debts.

It is especially useful in companies with significant tangible assets or when a more accurate picture of “real” value is needed.

Adjusted Book Value = Adjusted Assets – Adjusted Liabilities

3.3 Liquidation Value

Liquidation value estimates how much the company would be worth If you had to sell all your assets today and pay off all your debts. It's calculated based on quick sale prices, so it's usually lower than other methods.

It is used in scenarios such as:

Closing of operations

Bankruptcy proceedings

Financial restructuring

Liquidation Value = Liquidation Value of Assets – Liabilities

Note: The value of the assets is estimated at forced sale prices (discount with respect to market value).

3.4 Free Cash Flow to Firm (FCFF)

The FCFF is based on the expected future cash flows of the company, before paying debt and taxes. It is ideal for calculating the total value of the business, including both shareholders and creditors.

It is used when seeking to determine the operational value of the business, regardless of its financial structure.

Basic FCFF formula:

FCFF = EBIT × (1 – Tax Rate) + Depreciation and Amortization – Investment in Working Capital – Investment in Fixed Assets

And to calculate the value of the company:

Enterprise Value = ∑ FCFF / (1 + WACC)ⁿ

Where:

EBIT: Earnings before interest and taxes

WACC: Weighted average cost of capital

n: Number of projected years

3.5 Free Cash Flow to Equity (FCFE)

The FCFE is also based on future cash flows, but after paying debt and taxesIn other words, it shows what would actually be available to shareholders.

This approach is ideal for valuing the company from the point of view of the investor or shareholder, and is widely applied in the valuation of companies with more complex capital structures.

Basic FCFE formula:

FCFE = Net Income + Depreciation – Capital Expenditure – Change in Net Debt

And to calculate the value of the capital:

Capital Value = ∑ FCFE / (1 + Ke)ⁿ

Where:

Ke: Cost of equity

3.6 Market Multiples

This method compares a company with other similar companies in the same sector. It uses indicators such as:

EV/EBITDA (Enterprise value / Operating result)

P/E (Share Price / Earnings per Share)

P/B (Price / Book Value)

It is a quick and practical technique, widely used by analysts and investors to determine whether a company is "expensive" or "cheap" relative to the market.

These multiples allow the value of a company to be estimated by applying the relationship observed in comparable companies:

Estimated Value = Comparable Multiple × Company Metric

4. Considerations when Valuing a Company

When valuing a business, it is essential to take into account a number of key considerations to ensure an accurate and complete valuation:

- Economic and market environment: It is crucial to understand the economic and market environment in which the company operates, including macroeconomic trends, competition, regulations and external factors that may affect its performance and valuation.

- Financial history: Analyzing a company's financial history, including revenue, costs, profit margins, cash flows, and trends over time, provides important information about its financial health and ability to generate profits.

- Growth potential: Assessing a company's future growth potential is critical to determining its value, and may include considering expansion opportunities, new markets, technological innovation, and product development strategies.

- Tangible and intangible assets: Both tangible assets (such as property, equipment and inventory) and intangible assets (such as brand, intellectual property and customer relationships) must be properly valued, as both contribute to the total value of the company.

- Debt and financial obligations: It is important to consider a company's debt and other financial obligations when performing a valuation, as they can affect its net worth and ability to generate returns for investors.

- Future cash flows: Projecting the company's future cash flows is fundamental to valuation methods based on net present value (NPV) or discounted cash flows (DCF), as it provides an estimate of the present value of expected benefits.

- Risks and uncertainties: Identifying and assessing the risks and uncertainties associated with the company and its industry is essential to determining a fair and realistic value, which may include operational, legal, regulatory, market and other risks that may affect its future performance.

By considering these and other relevant considerations, valuers can conduct a comprehensive and informed valuation of a business, providing a sound basis for strategic and financial decision-making.

5. Benefits of Valuing a Company Annually

It is important to note that many companies only opt for a professional valuation in specific situations, such as mergers or acquisitions, however, this practice should not be limited to such circumstances alone, as an annual business valuation can be a valuable process for any company wishing to monitor its progress, compare itself to its competitors and plan for growth. Furthermore, a periodic valuation can also be beneficial as a precursor to partnerships or business negotiations.

A valuation is carried out by an expert in order to provide an overview of the competition in the market where your company operates, the value of its assets and the associated revenues. Both publicly traded companies and those with private investors can use an annual business valuation to demonstrate their growth year after year. The key idea is that an annual business valuation can provide a number of advantages to your company. Before we delve deeper into this, it is important to understand the different approaches to business valuation.

BENEFIT | |

Valuable information for non-commercial events | A business valuation is not only useful for business matters, but also for personal situations such as estate planning, business succession, or impending divorces. Such important events require an accurate assessment of assets, including the business, which is considered an asset of the entrepreneur. Conducting an annual business valuation provides a better understanding of its value, revealing that it may be one of the entrepreneur's most important assets. |

Decision making process | A professional business valuation provides accurate figures and a realistic view of a company's financial health, which is crucial since profitability, revenue and expense calculations can be risky and provide insufficient information, having concrete data allows business owners to make strategic changes, and an annual valuation provides access to the information necessary to make important decisions about the organization. |

Assess the risks | Opting for an annual business valuation provides entrepreneurs with crucial information to mitigate risks and make informed financial decisions. In addition to assessing the viability of taking on more debt and better understanding long-term asset depreciation, a valuation also helps determine the level of risk aversion to operate in the future. |

Market value | Knowing the market value of your business is crucial to setting a fair price when selling it, avoiding overvaluing or undervaluing it. Even if you have no plans to sell, understanding this value is beneficial. In addition, knowing the resale value facilitates future planning and provides advantages in business transactions, since an accurate valuation of the value of your company is essential for mergers, acquisitions and business succession planning. |

Security for interested parties | It is essential to know the financial health of a company in which you have an interest as an employee, investor, manager or owner. Conducting an annual business valuation is recommended to provide peace of mind to the company's stakeholders. This is because investors need information about financial stability and growth prospects to feel safe when investing. An annual valuation can improve the company's transparency and increase stakeholder confidence. |

6. Business Valuation for Entrepreneurs

Business valuation is a crucial part of the process for entrepreneurs, as it allows them to understand the value of their business and make informed strategic decisions. For entrepreneurs, valuation is not only important for the sale of the company, but also for obtaining financing, negotiating with potential investors and partners, and planning the long-term growth strategy. However, since many startups may have unpredictable cash flows or intangible assets that are difficult to value, valuation can be challenging.

For entrepreneurs, it is essential to have a clear understanding of the methods of valuation available and how to apply them to your businessIn many cases, approaches based on the future potential of the company, such as the income approach or the comparative valuation approach, may be more relevant than methods based on tangible assets, and entrepreneurs should consider how potential investors will perceive the risk and potential of their business when making a valuation.

In addition, entrepreneurs may face additional challenges when conducting a valuation, such as a lack of financial history or uncertainty about the market and competition. In such cases, creative approaches may be necessary to estimate the value of the company, such as the use of key performance metrics, scenario analysis, and comparisons with similar companies at similar stages of development.

So business valuation for entrepreneurs is a complex but crucial process that requires understanding, analysis and strategic vision, because by understanding the available valuation methods and how to apply them to their specific business, entrepreneurs can make informed decisions that drive the long-term growth and success of their company.

6.1 Example of Business Valuation for Entrepreneurs: "TechInno SA" (Tech Startup)

Context

TechInno SA is a startup that develops innovative software for the management of small and medium-sized enterprises (SMEs). The company has one year of operations, with a accelerated growth on its customers, but its cash flow is still limited due to investments in product development and expansion. TechInno has reached $500,000 in annual sales and has a growth projection of the 50% annual over the next 3 years. However, the company is not yet profitable.

Since the company has a growing customer base and a valuable intellectual property (your software), the goal of the valuation is to understand its potential long-term value to attract venture capital investors (VC) and get additional financing.

Income Valuation Approach (Income Multiplier)

The income approach is based on projecting the future flows of the company's income, and then apply a multiple that takes into account the characteristics of the industry and growth potential.

Basic data:

- Current sales: $500,000 annual

- Projected growth rate: 50% annual for 3 years

- Revenue multiple in the software industry: In the technology industry, venture capitalists typically use a revenue multiple that ranges from 5x and 10x, depending on factors such as growth, profitability and risk. Since TechInno It is a startup with high growth potential, we will use a multiple of 8x.

Step 1: Project future revenue

Yeah TechInno continues to grow at 50% annually over the next 3 years, its earnings could look like this:

- Year 1: $500,000 (current sales)

- Year 2: $500,000 * 1.5 = $750,000

- Year 3: $750,000 * 1.5 = $1,125,000

- Year 4: $1,125,000 * 1.5 = $1,687,500

Step 2: Calculate the future value of income

Based on the revenue projection, the value of the company is calculated by applying the revenue multiple (8x):

- Company value = Projected revenue in year 4 × Revenue multiple

- Company value = $1,687,500 × 8 = $13,500,000

Result of the Income Approach:

According to this approach, the estimated value of TechInno SA is $13.5 million, based on future earnings potential and industry multiple.

2. Comparative Valuation Approach (Comparison with Similar Companies)

He comparative method It is based on comparing the startup with similar companies in terms of size, industry and stage of development. Metrics such as the income multiplier or the EBITDA multiplierIn this case, we will use the revenue multiple to compare TechInno with similar companies in the technology industry.

Basic data:

- Comparable companies:

- Company A: $5 million in annual revenue, 6x revenue multiple

- B Company: $1 million in annual revenue, 7x revenue multiple

- Company C: $3 million in annual revenue, 8x revenue multiple

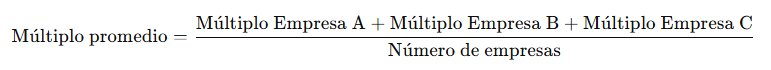

Step 1: Calculate the average revenue multiple

To calculate the average of the multiples of comparable companies, we use the formula:

Where:

- Company A Multiple = 6

- Company B Multiple = 7

- Company C Multiple = 8

Replacing:

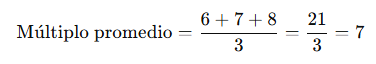

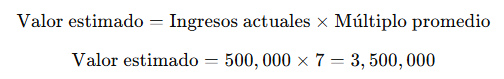

Step 2: Apply the average multiple to current earnings

We calculate the estimated value using the average multiple and current earnings:

Result of the Comparative Approach:

The estimated value of TechInno SA is $3.5 million.

Conclusion

Both methods show different perspectives:

- Income approach: Values TechInno at 1Q4T13.5 million, considering its projected growth and industry multiple.

- Comparative approach: Values TechInno at $3.5 million, based on its current situation and the average of comparable companies.

This difference reflects the impact of future growth potential versus current conditions.

6.2 Considerations for Entrepreneurs

- Investor Perspective: The venture capital investors They often focus more on the future growth potential than in tangible assets or current income. That's why the forward-looking income approach is a valuable tool to capture their interest.

- Challenges in Valuing Startups: Since many startups have uncertain cash flows either limited financial histories, methods such as the revenue multiple or the growth projections are crucial to reflect the value based on the company potentialEntrepreneurs should be prepared to justify their projections and assume that investors may apply discounts for risk.

- Importance of Goodwill and Intangible Assets:Tech startups often have valuable intangible assets, such as intellectual property, patented technologies and loyal customer bases, which may not be fully reflected in the accounting figures. These elements must be effectively communicated to investors.

- Risks and Opportunities: Entrepreneurs must be aware of the risks involved in growth projections, especially in highly competitive markets. However, they must also see this as an opportunity to demonstrate your vision and ability to scale the business.