Software appraisal

Software appraisal - software valuation

index

What is Software as an Asset?

He software is a asset intangible compound by programs computer scientists designed for execute tasks specific in computers, servers or others devices. His worth strategic ha grown exponentially in he around business current, being fundamental in the operation, automation, analysis of data and generation of income.

What is a Software Appraisal?

The appraisal of software is he process through he which HE determines he worth economic of a program either set of programs computer scientists. This process It allows know with precision how much represents this asset inside of the heritage of a organization, and can apply so much to software developed internally as to solutions acquired either graduates.

What types of software can be appraised?

| Type of Software | Description | Considerations for Appraisal |

|---|---|---|

| Internally developed software | Programs created by the company's internal team. | Evaluate development, maintenance and strategic value costs. |

| Purchased software (commercial licenses) | Solutions purchased from third parties under licensing schemes. | Analyze purchase price, conditions of use and useful life. |

| Custom applications | Custom software, developed by external suppliers according to specific requirements. | Consider development contracts, intellectual property, and degree of customization. |

| Comprehensive systems (ERP, CRM, SCM, etc.) | Enterprise platforms or complex solutions, including web, mobile, or integrated versions. | Estimate operational impact, implementation costs, and projected benefits. |

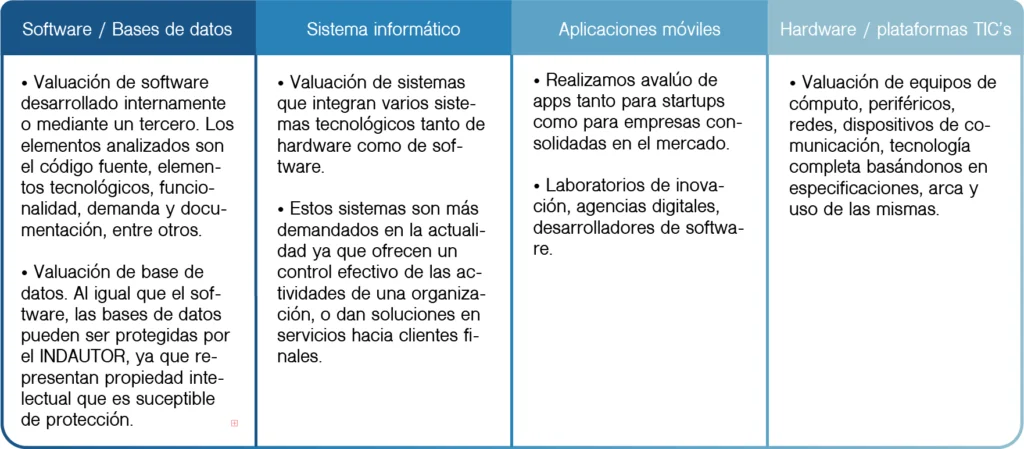

Appraisal Service Structure by Software Architecture Type

What is Software Valuation for?

Carry out a appraisal adequate of software allows:

Medium in transactions commercials (buys, sale, fusion, acquisition, discharge).

Take of decisions strategic, based in he worth real of the assets.

Access to financing, already that he software can be considered as warranty in view of investors either institutions financial.

Management accountant and fiscal, allowing a better record of assets intangibles.

Protection of the property intellectual, to the support legally he worth of programs own.

Assessment of risks in audits either reviews heritage.

Benefits of Software Valuation

Software Valuation Methods

Approach of Costs

Calcula he worth My dear to to leave of the cost of reproduction either replacement of the software. HE consider items as:

Hours of development

Licenses of third parties

Costs of evidence, documentation and medium

Infrastructure associated

Approach of Market

Compare he software with products similar in he market, taking in account prices of reference, conditions of marketing, and licenses available.

Approach of Income

Projects the benefits economic futures that will generate he software and the discount to worth present. Is ideal for software that improvement income either efficiency operational.

What documentation is needed for the Appraisal?

A appraisal precise and professional requires he back of information technique, legal and financial. Some documents clue include:

Contracts of development either discharge

Records of property intellectual

Manuals technicians either functional

States financial related

Projections of income attributable to the software

Evidence of costs of development

What Standards or Regulations Govern Software Valuation?

The appraisal of assets intangibles as he software has to line with frames normative recognized, as:

Rules International of Rating (IVS)

Rules of Information Financial (IFRS), in particular the NIC 38 – Assets Intangibles

Legislation local of property intellectual and rights of author

Guidelines of the Organization World of the Property Intellectual (WIPO)

Achieve with are guidelines guarantees transparency and reliability in view of third parties as auditors, investors either authorities prosecutors.

IAS-38 and Software Appraisal

The NIC 38 – Assets Intangibles, issued by he IASB (International Accounting Standards Board), establishes the criteria accountants for he recognition, measurement and presentation of assets intangibles in the states financial, including he software.

According to the NIC 38, a software can be recognized as asset intangible Yeah fulfills with the following requirements:

Identifiability: Can separate of others assets and sell, transfer, graduate either to be rented individually.

Control: The company has he can of obtain benefits economic futures and restrict he access of third parties.

Benefits economic futures: He software has to trigger income direct either indirect, as reduction of costs either improvement in the efficiency operational.

Implications for the Appraisal of Software

The appraisal of software, from the perspective accountant, has to achieve with the guidelines of the NIC 38 for:

Determine he worth reasonable of the software in acquisitions, mergers either licensing.

Activate the costs of development of software internal when sea technically viable, economically profitable and controllable by the company.

Amortize he software during his life useful dear, based in the ability of trigger benefits futures.

Review he deterioration of worth, when exist clues of that his worth can have been reduced.

Who Should Perform a Software Appraisal?

The appraisal of software has to be carried out by professionals with experience in assessment of assets intangibles, analysis financial and knowledge technical in technologies of the information. Count with a signature specialized provides:

Methodologies recognized

Objectivity and impartiality

Medium documentary for use legal, accountant either fiscal

Alignment with rules international

International Considerations

The protection legal and he record of the software varies according to he country, but generally this regulated low laws of rights of author and treaties international. Is important verify:

The jurisdiction where HE register either markets he software

He scope of the protection legal (code fountain, interfaces, documentation)

Compatibility with rules accountants and of report financial locals

ANEPSA GLOBAL

In ANEPSA Global, we count with further of 30 years of experience performing appraisals of assets tangible and intangibles. Our equipment multi-disciplinary tea supports for identify, analyze and assess your developments of software with precision, low the further tall standards international.

Contact us today for a advice personalized and discover as a appraisal of software can enhance he worth of you company.